Stock photo of calculator. Use our Child Tax Credit calculator to estimate how much of the credit you can expect monthly and when you file your return next year.

What Is the Child Tax Credit.

Irs 2019 child tax credit calculator. The Child Tax Credit is now worth up to 2000 per qualifying child. Heres how to calculate how much youll get. STOCK PHOTOGetty Images.

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. The 2019 DEPENDucator Tax Tool will find out for you if someone is your Qualifying Child and your dependent. Depending on your income the 2019 Child Tax Credit Calculator could save you up to 2000 for each qualifying child.

Our guide is going to introduce a child tax credit calculator you can rely on and show you exactly how much you can get from the IRS and how this tax credit works. It only applies to dependents who are younger than 17 as of the last day of the tax year. New Child Tax Credit Rules from 2018.

The age cut-off remains at 17 the child must be under 17 at the end of the year for taxpayers to claim the credit. The refundable portion of the child tax credit is limited to 1400 15 of earned income for the tax year 2018 subject to income phaseout. Just answer the Yes and No questions until the 2019 DEPENDucator.

The credit is worth up to 2000 per dependent for tax year 2020 but your income level determines exactly how much you can get. The child credit is a credit that can reduce your Federal tax bill by up to 2000 for every qualifying child. Under the Tax Cuts and Jobs Act TCJA the following new child tax credit rules will take place starting in 2019.

The new child tax credit will provide 3000 for children ages 6 to 17 and 3600 for those under age 6. Then use the 2019 IRS Tax Forms and complete them online before you mail them in. Once you have determined if you can claim the Child Tax Credit use the free 2019 Tax Calculator or TaxStimator to calculate and estimate your tax refund or taxes owed for the current Tax Year.

Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the. What is the Child Tax Credit. The Child Tax Credit changes make it worth up to 2000 per qualifying child.

Have a Social Security Number SSN Be under 17 years of. The child tax credit math is somewhat involved this time around. Just answer the questions and follow the steps.

You can save thousands every single year through claiming the child tax credit. So what child tax credit IRS allows in 2018 or 2019. You will claim the other half when you file your 2021 income tax return.

The dependents tax credit calculator will enable you to figure out if you can claim your child as a dependent on your tax return and how much you can get. Using the 2019 Child Tax Credit Calculator. For parents of eligible children up to age 5 the IRS will pay 3600 half as six monthly payments and half as a 2021 tax credit.

The child tax credit math is somewhat involved this time around. The American Rescue Plan Act which President Biden signed into law on March 11 temporarily increases the child tax credit from 2000 to 3000 per child 3600 for children. These changes apply to tax year 2021 only.

Families can expect the first payments to be received by direct deposit on or around July 15 2021. Child Tax Credit calculator. The changes increased the child tax credit from 2000 to 3000 for children over 6 and to 3600 for children under 6.

Citizen or resident alien. The Child Tax Credit CTC is designed to give an income boost to the parents or guardians of children and other dependents. Find answers on this page about the child tax credit payment the calculator and why you may want to use the IRS child tax credit portal.

To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. Advance payments for the Child Tax Credit start July 15. Our child tax credit calculator tells you how much money you might receive in advance monthly payments in 2021 and how much of the credit youll claim when you file your return next year.

Major child tax credit changes are as under. This type of dependency credit is highly valued by families. According to the IRS.

For parents of eligible children up to age 5 the IRS will pay 3600 half as six monthly payments and half as a 2021 tax credit. To qualify your child must.

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc7 San Francisco

Hooray This Irs Tool Will Tell You If You Qualify For Child Tax Credit Payments Cnet

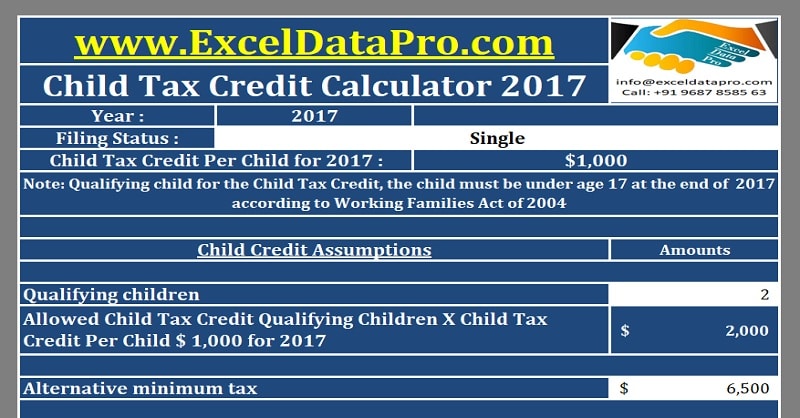

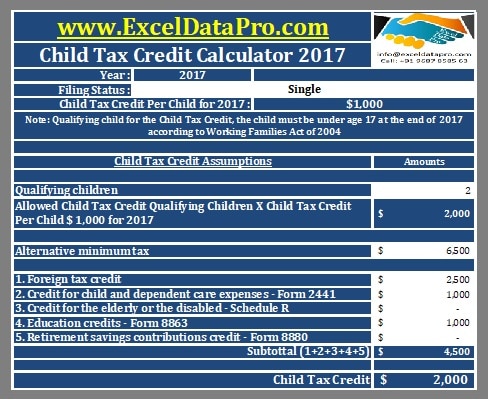

Download Child Tax Credit Calculator Excel Template Exceldatapro

This Irs Tool Indicates Whether You Are Eligible For A Child Tax Credit Payment Click Here For How To Use Fuentitech

Use This Irs Tool To See If You Qualify For Child Tax Credit Payments Here S How Cnet

Download Child Tax Credit Calculator Excel Template Exceldatapro

Download Adoption Tax Credit Calculator Excel Template Exceldatapro

What Is Irs 1040ez Tax Form Tax Forms Income Tax Return Income Tax

Irs Form 8962 Calculate Premium Tax Credit Tax Relief Center Irs Forms Tax Credits Irs

July 15 Child Tax Credit Check For 250 Or 300 Calculate Your Total In Less Than A Minute Cnet

Tax Debt Categories How Much Taxes Do I Owe The Irs Tax Debt Tax Help Owe Taxes

First Child Tax Credit Checks In 8 Days Here S How Much Your Family Will Receive Cnet

Child Tax Credit Faq What To Know Before Your First Payment In 5 Days Cnet

Hooray This Irs Tool Will Tell You If You Qualify For Child Tax Credit Payments Cnet

Child Dependent Care Tax Credit Calculator Tax Credits After School Program Tax

Fillable Form 1040 Individual Income Tax Return In 2021 Income Tax Return Tax Return Income Tax